Unmasking the Dark Cloud Cover: A Powerful Reversal Signal in Forex Trading#

Introduction#

Candlestick patterns have been widely embraced by traders and analysts as powerful tools for interpreting price movements and identifying potential trend reversals in financial markets. One notable pattern that has garnered attention is the Dark Cloud Cover candlestick pattern. This bearish reversal signal can provide valuable insights into market dynamics and aid traders in making informed decisions.

In this post, we will explore the Dark Cloud Cover pattern, its key characteristics, and delve into the psychology behind its formation. By understanding how to recognize and interpret this pattern, traders can gain a deeper understanding of market sentiment and enhance their trading strategies. Through the exploration of real-world examples and analysis, we will uncover the significance of the Dark Cloud Cover pattern and its implications for traders in the dynamic landscape of financial markets.

Characteristics of the Dark Cloud Cover Pattern#

The Dark Cloud Cover pattern is a two-candlestick formation that provides a bearish reversal signal in technical analysis. Understanding its key characteristics is crucial for identifying and interpreting this pattern correctly. Here are the main characteristics of the Dark Cloud Cover pattern:

Two Candlesticks: The Dark Cloud Cover pattern consists of two consecutive candlesticks.

The first candlestick is a bullish (up) candle, indicating an ongoing uptrend.

The second candlestick is a bearish (down) candle, signaling a potential reversal.

Bearish Engulfing: The second candlestick of the Dark Cloud Cover pattern engulfs the previous bullish candle, opening above its high and closing below its midpoint.

The bearish candle’s body should be larger than the bullish candle’s body.

The bearish candle’s close should be near or below the halfway point of the bullish candle.

Confirmation: To confirm the Dark Cloud Cover pattern, traders often look for additional indicators or factors:

Proximity to Resistance: The pattern gains more significance when the bearish candle approaches or touches a resistance level.

Volume: A notable increase in volume during the formation of the bearish candle strengthens the validity of the pattern.

Timeframe: The Dark Cloud Cover pattern can occur on various timeframes, such as daily, weekly, or intraday charts. The significance of the pattern may vary depending on the timeframe.

Bearish Reversal Signal: The Dark Cloud Cover pattern is considered a bearish reversal signal, suggesting a potential change in market sentiment from bullish to bearish. It indicates that the selling pressure has intensified, potentially leading to a trend reversal or price correction.

It is important to note that while the Dark Cloud Cover pattern provides a potential reversal signal, confirmation from other technical indicators, such as trend lines, oscillators, or support/resistance levels, is advisable before making trading decisions. Additionally, considering the overall market context and conducting comprehensive analysis can help mitigate false signals and improve the effectiveness of trading strategies based on the Dark Cloud Cover pattern.

The Psychology behind the Dark Cloud Cover pattern#

Understanding the psychology behind the Dark Cloud Cover pattern can provide valuable insights into the dynamics between market participants and shed light on the potential implications of this bearish reversal signal. Here are the key psychological factors at play:

Shift in Market Sentiment: The Dark Cloud Cover pattern reflects a shift in market sentiment from bullish to bearish. It signifies a change in the balance of power between buyers and sellers, indicating that the bears have gained momentum and are exerting their influence on the market.

Battle between Bulls and Bears: The pattern represents a struggle between the bulls and bears. The first bullish candle of the pattern suggests that the buyers are in control and pushing prices higher. However, the subsequent bearish candle indicates that the bears have stepped in and overwhelmed the bulls, driving prices down and potentially initiating a reversal.

Reaction to Resistance Levels: The proximity of the Dark Cloud Cover pattern to resistance levels adds to its psychological significance. When the bearish candle approaches or touches a resistance level, it indicates that selling pressure has intensified as market participants view the resistance as a level of potential reversal or profit-taking.

Emotional Response: The formation of the Dark Cloud Cover pattern can trigger emotional responses among traders. Those who were bullish and had positions at higher levels may feel anxious or uncertain as the bearish candle engulfs the previous bullish candle, potentially leading to profit-taking or stop-loss orders being triggered.

Market Participant Behavior: The Dark Cloud Cover pattern can influence market participants’ decision-making. As the pattern suggests a potential reversal, traders who missed the initial uptrend may see it as an opportunity to enter short positions or close long positions. Additionally, it may attract the attention of trend-following traders looking for confirmation of a potential trend reversal.

Understanding the psychology behind the Dark Cloud Cover pattern enables traders to gauge the prevailing sentiment, anticipate potential reactions from market participants, and make informed trading decisions. However, it is important to consider the pattern in the broader context of technical analysis, combining it with other indicators and confirmation techniques to increase the reliability of signals and reduce the risk of false reversals.

Paramters for the backtests#

For this particular analysis, we worked with the following parameters:

Starting balance: $10,000

Margin: 1:100

Commission: None

Testing period: From January 1, 2020, to December 31, 2022

Timeframe: 15 minutes

Currency pair: EURUSD

Data Source: Dukascopy

Backtesting and evaluating the Dark Cloud Cover pattern#

Backtesting the Dark Cloud Cover candlestick pattern by taking short positions on the bearish Dark Cloud Cover, while testing different exit strategies, is a critical process for evaluating the effectiveness of this trading approach. By utilizing historical price data and establishing specific trading rules, traders can simulate trades based on the occurrence of Dark Cloud Cover patterns. This enables them to assess the profitability and robustness of the strategy.

Through backtesting across various exit strategies, traders gain valuable insights into the potential profitability and risk management aspects associated with trading the Dark Cloud Cover candlestick pattern.

Sell Rules

Identify the bearish Dark Cloud Cover candlestick.

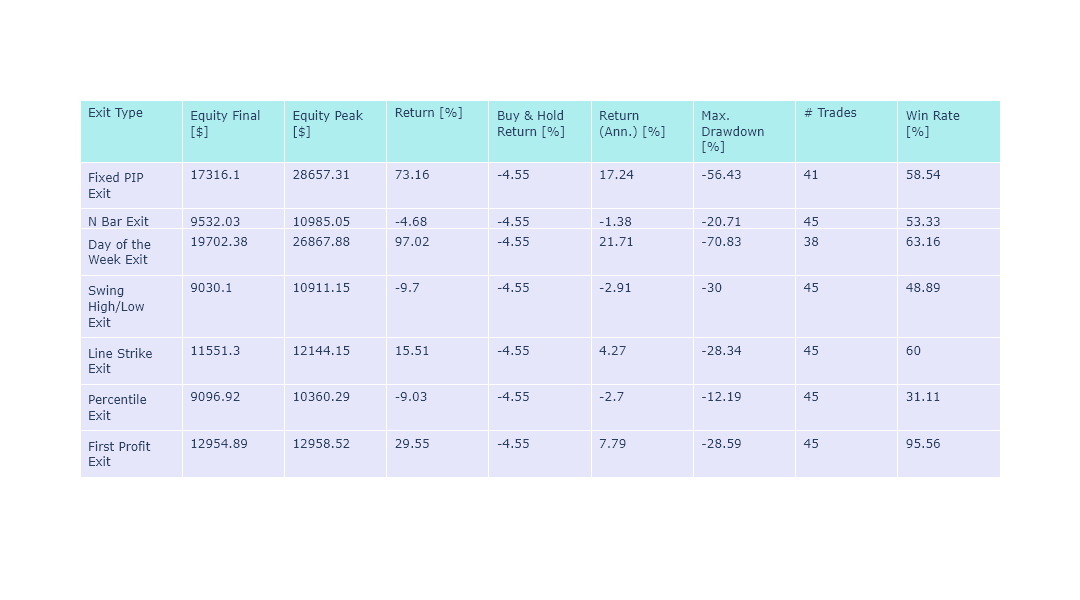

Results

Backtesting the Dark Cloud Cover candlestick and Pivot Points strategy#

Through our rigorous testing, we have embarked on an in-depth exploration of two versions of this strategy, which we are excited to unveil. However, our quest for knowledge doesn’t stop there. We are determined to push the boundaries even further by subjecting it to a wide array of diverse exit strategies. Before diving into the details, let us first introduce the essential pivot points that hold a pivotal role in our comprehensive analysis. The pivot points we rely on are:

Version 1

Sell Rules

Close of the bearish Dark Cloud Cover must be below the support pivot point.

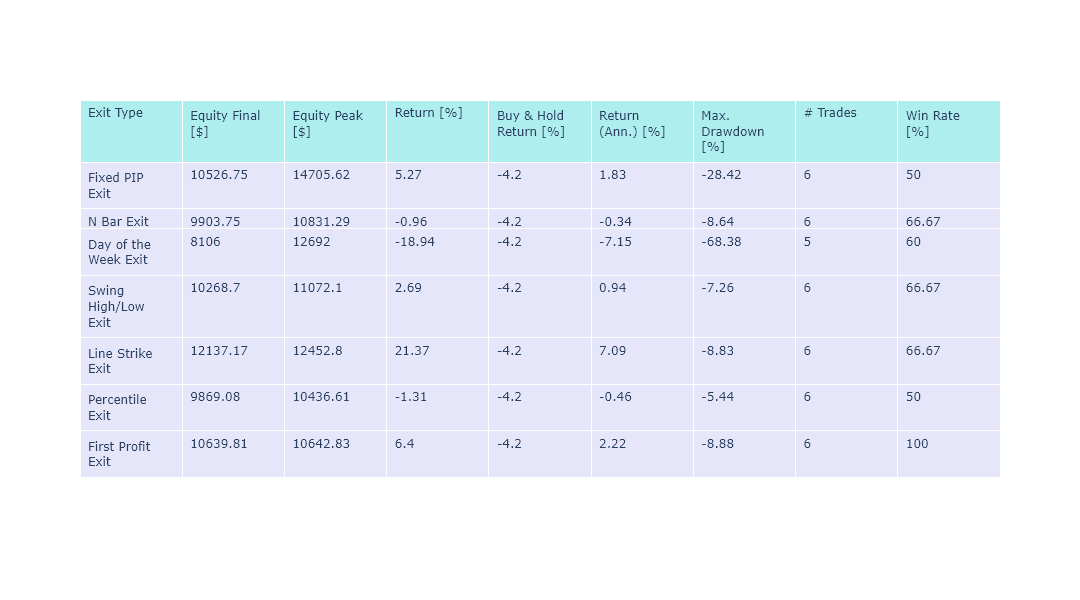

Results

Version 2

Sell Rules

Close of the bearish Dark Cloud Cover must be above the resistance pivot point.

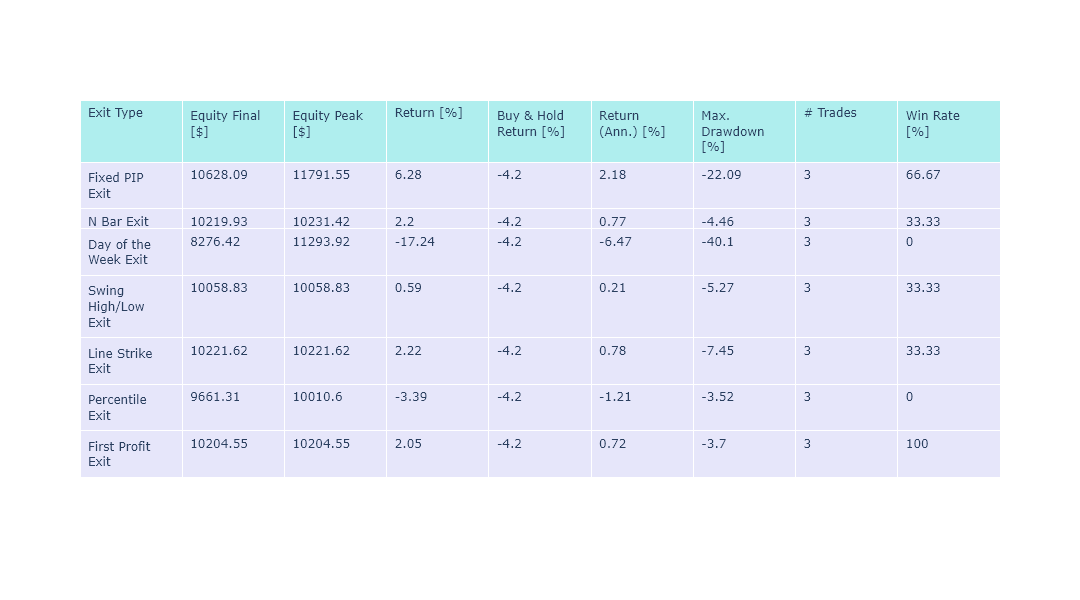

Results

Source Code#

Here is the link to the source code for this zeta-zetra/code.