Moving Average and Oscillators#

Here is the strategy name: Range-Bound Strategy with Moving Averages and Oscillators

Strategy Details#

Here are the strategy details from ChatGPT:

Note

Apply two moving averages of different periods to the price chart.

Wait for the shorter-term moving average to approach and bounce off the longer-term moving average, indicating a potential range-bound market.

Use an oscillator, such as the Relative Strength Index (RSI) or Stochastic Oscillator, to identify overbought and oversold conditions within the range.

Enter a long trade when the price bounces off the moving averages and the oscillator is in oversold territory.

Enter a short trade when the price bounces off the moving averages and the oscillator is in overbought territory.

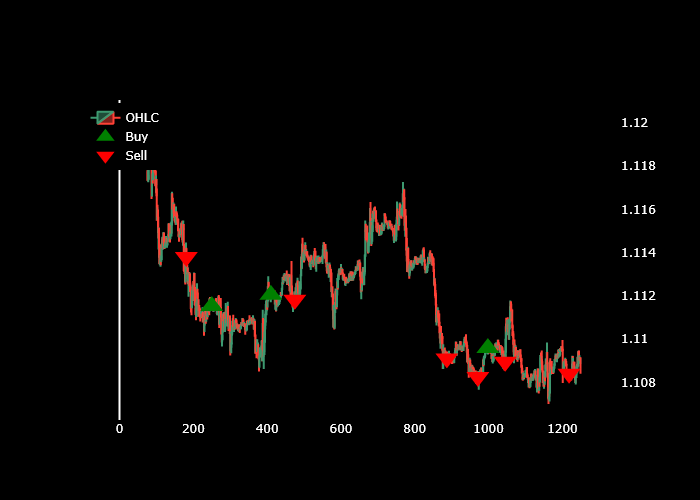

Sample Signal Points#

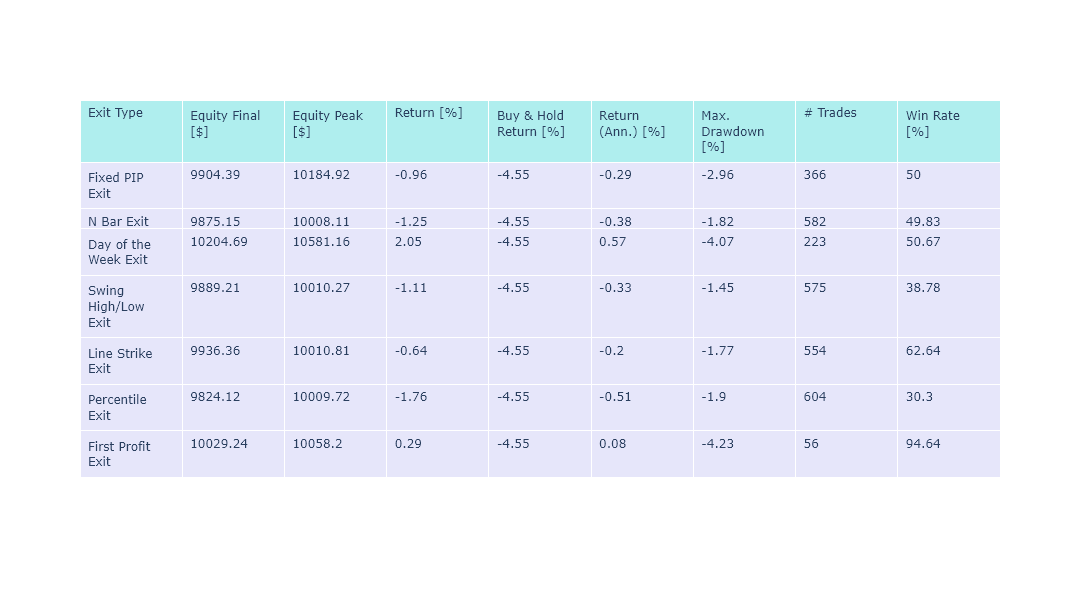

Results#

Source Code#

Here is the link to the source code for this zeta-zetra/code.